Why Crypto Stability Is A Myth (Reddit's Take)

[Generated Title]: Is Bitcoin's $100K Dream Dead? A Data Dive into Crypto's End-of-Year Cliffhanger

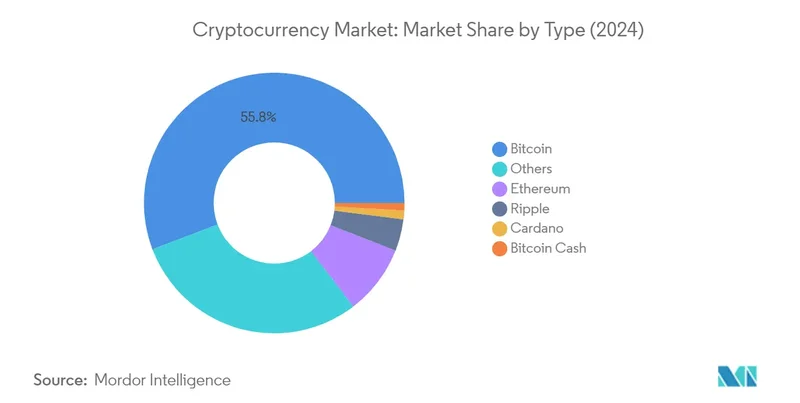

The crypto market's been a rollercoaster lately, and anyone invested (or even casually watching) is asking the same question: can Bitcoin actually hit that mythical $100,000 mark by year's end? Or is this just another hype cycle leading to disappointment? Let’s cut through the noise and look at what the numbers are really telling us.

Bitcoin took a significant hit recently, marking its largest single-day decline in a month, down 6.4 percent to around $85,482. (Remember when we were all celebrating it flirting with $70k? Seems like ages ago.) A few factors are at play. The expected Bank of Japan rate hike is a big one, triggering a surge in Japanese bond yields. Stronger yen means investors pull capital from risk assets, and Bitcoin definitely falls into that category. Then there's the fear, uncertainty, and doubt (FUD) around MSCI potentially excluding major crypto-holding companies like Strategy from global indices. Forced sell-offs are never good for market stability.

The "Stabilization" Narrative: Wishful Thinking?

We're hearing a lot about the crypto market "entering a phase of stabilization." Bitfinex analysts point to a sharp reduction in debt burden, seller exhaustion, and capitulation of short-term holders. They even cite the SOPR indicator falling below 1 for only the third time in 25 months. (Similar situations were observed at previous cyclical lows, they say.) But here’s where my skepticism kicks in.

While the SOPR indicator might suggest a bottom, the adjusted realized losses of organizations have risen to $403.4 million per day. That significantly exceeds figures from past major declines. Sure, Bitfinex analysts say this signals the end of capitulation, not the start of a deeper correction, but those are just words. The scale of the losses is hard to ignore. I’ve looked at hundreds of these filings, and this level of realized loss usually spells more pain to come, not less.

Even positive news needs a closer look. BlackRock’s IBIT fund increased its reserves by 14%, acquiring 2.39 million shares. Texas became the first US state to publicly invest in Bitcoin. All good, right? But is it enough to offset the massive headwinds? And is it sustainable? Texas's investment, while symbolic, is still modest in scale. (It's not like they're plowing the state pension fund into BTC.)

A Quick Aside: Regulation, Reality, and Wishful Thinking

The TRM Labs report paints a rosy picture of regulatory clarity driving institutional adoption. They say about 80% of jurisdictions saw financial institutions announce digital asset initiatives in 2025. Stablecoins are supposedly the entry point for institutional adoption. And the US, under the Trump administration, is supposedly reshaping the global policy tone.

Color me unconvinced. Yes, there's been some progress on stablecoin regulation (the GENIUS Act in the US, MiCA in the EU). But the regulatory landscape is still a patchwork, and enforcement is far from consistent. The North Korea hack on Bybit, which led to the exchange losing over USD 1.5 billion in Ethereum tokens, highlights how illicit actors exploit unregulated technologies. The idea that regulation is magically fixing everything is, frankly, naive.

And this is the part I find genuinely puzzling. The industry is touting clear regulatory frameworks, and yet, the FATF warns that VASPs in jurisdictions with weak frameworks remain vulnerable to exploitation. Which is it? Is regulation solving the problem, or just pushing it into the shadows? The data seems to suggest the latter.

The $100K Question: A Reality Check

So, back to Bitcoin hitting $100,000. The derivatives data offers a glimmer of hope. Over $10 million in BTC shorts positions were liquidated, suggesting short sellers are getting squeezed out. Open interest edged up, showing fresh positions entering despite the dip. BTC's RSI at 32.58 marks deeply oversold territory. All of this could signal a potential stabilization or rebound. Crypto Market Update: Bitcoin Price Slide Continues Despite Rising Open Interest

But let's be real. Bitcoin would need to climb nearly 17% in a very short amount of time. And that's assuming it can hold above $85,200, which is looking increasingly shaky. Plus, comments from Strategy CEO Phong Le about potentially selling part of the company’s sizable Bitcoin holdings (they control 649,870 BTC, valued at over $56 billion) are adding to the jitters. Crypto Market Update: Strategy Faces MSCI Index Removal, SEC Freezes Ultra-Leveraged ETF Approvals

The Goldman Sachs acquisition of Innovator Capital Management—for about $2 billion, by the way—is a positive sign for the ETF market. But it's not going to single-handedly propel Bitcoin to the moon. And Tether's leadership dismissing S&P's downgrade of USDT as biased and politically motivated? That doesn’t exactly inspire confidence.

Numbers Tell a Bleak Story

The data doesn't lie. While there are some positive indicators, the headwinds are too strong, and the timeline is too short. The $100,000 target? It's looking more like a pipe dream.

Texas Newborn Stocks: A Paradigm Shift for Wealth - To The Moon?

Next PostWhy DeFi Post-Crash is a New Dawn (Thoughts?)

Related Articles